Your next step-a surprising one if you are not already aware of it-is to reduce the expense total by the amount of tuition and related expenses used to generate the education tax credit claimed on either your or your beneficiary’s tax return. If a payment is made by the 529 plan directly to the school, the timing of the expense and the Form 1099-Q automatically matches up, and you don’t have to worry about it. If you mailed the tuition payment on December 31, but the school does not receive it until January 3, count it as 2015 expense even when the school records it as a 2016 payment (one reason to ignore the Form 1098-T). Incidentally, the timing of your expenses can get a little tricky, especially for payments made close to the end of the year. Be sure to include qualifying expenses paid using student loans, but exclude tax-free scholarships. Instead, simply use your own checkbook, paper or electronic receipts, and student account records maintained at the school to add up all the qualified higher education expenses paid by, or for, your beneficiary during the tax year. When determining the tax treatment of your 529 plan withdrawals, the Form 1098-T is close to worthless.

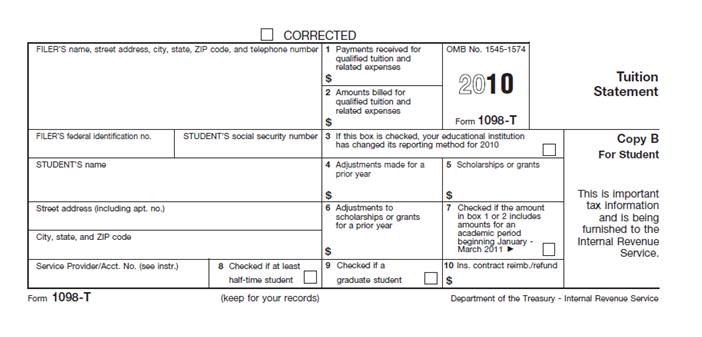

The school your beneficiary attends is required to send out Form 1098-T to report the tuition and related expenses either paid or billed during the year. This way, the beneficiary receives the Form 1099-Q and the IRS computers don’t send up red flags.

Avoid the hassle in the future by making sure your withdrawals are paid either directly to the school, or to your beneficiary. Some will advocate attaching a statement to your tax return that details your beneficiary’s college expenses and explains that the withdrawals are tax-free, but I am not convinced that will help.

0 kommentar(er)

0 kommentar(er)