The importers have a vital partnership with these agents who ensure that the shipment clears the port of entry. To understand how a typical US Customs Bond application form looks like, click HERE What is the role of Customs Bond Agents?Ĭustoms Bond agents play a key role in the smooth completion of the Customs Bond procurement and processing system. The customs bond consultant and the customs broker will also help you choose the type of Customs Bond your company requires depending upon the kind of goods you are importing into the country. It can also result in lesser hassles and significant cost savings. Purchasing your bond through a reliable and reputed customs broker ensures that your bond is from a highly rated surety company. When the customs bond is purchased, the customs broker files for a unique bond number on behalf of the importer. Where to buy a Customs Bond?Īs we have already read above, importers can buy a customs bond through their customs broker who directly deals with the bond provider or the surety company. For this, you must purchase a bond from a surety licensed by the US Treasury Department. The second way is to acquire the bond on your own. Reaching out to a customs broker is the easiest method of obtaining the bond as he/she is aware of the application processes and well-versed in handling the related documentation and paperwork. One way is by approaching the international freight forwarder or a reputed and established customs broker licensed in the US. There are two means of availing a Customs Bond. It covers all the goods entering the country by air and via sea. A Customs Bond is essential even when the shipment is transported from one state to another.

All the goods that are subject to federal requirements must be covered by the Customs Bond. How does a Customs Bond work?Ī Customs Bond makes the importing process easier for companies as it covers the payment of duties and taxes applicable on the goods imported into the US. The bond is valid for one year from the date it is issued. A Continuous Customs Bond is also needed for high-value shipments. This type of bond works well for those importers who deal with a large number of entries across several US ports of entry every year.

This bond is needed for covering multiple/ongoing entries made by an importer at all ports of entry into the US. It is best recommended for those companies that import less than four shipments into the US annually. This type of Customs Bond can be availed if the importer only imports low-cost value goods. Single Transaction Customs BondĪlso known as a Single-Entry Bond or SEB, this bond allows for a one-time customs entry. Listed below are the two types of Customs Bonds:- 1. This also applies to duty-free import shipments. For example in the US, besides the mandatory Customs Bond, all food items require additional documents as per the guidelines issued by The Food and Drug Administration (FDA). When do Importers need Customs Bond?Ī Customs Bond is essential for clearing customs of commercial goods valued over US$ 2,500 and is subject to specific payment requirements from other US government agencies. This is compulsory even when duty-free goods are imported into the country.

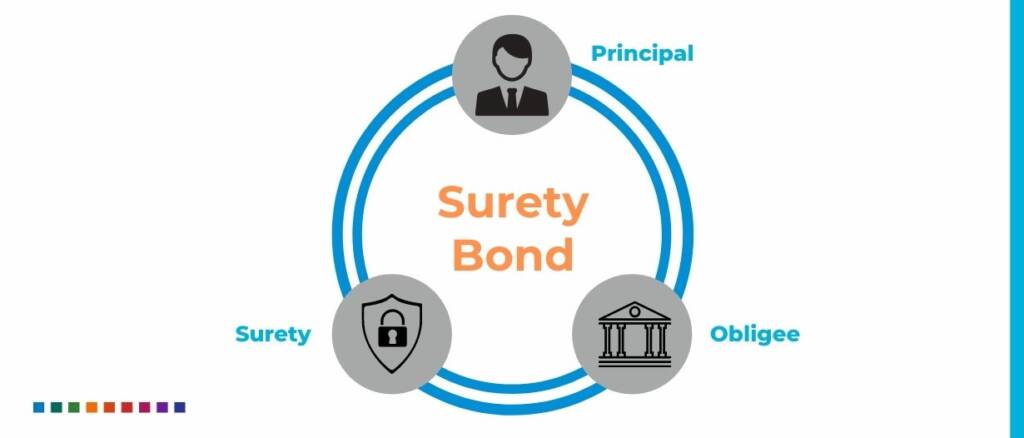

However, in case the importer for some reason such as bankruptcy cannot pay these amounts on time, the CBP collects the payment from the insurance company that issued the bond.ĬBP mandates all importers must file an Import Bond to clear their entries. Why is a Customs Bond needed?Īs stated above, the import bond guarantees that the CBP can collect all the duties, taxes, fines, or penalties associated with importing goods into the US. The surety company clears all the dues with the CBP after which the importer reimburses the surety. With this assurance, the CBP can immediately clear the shipment without waiting for the importer to pay. A Customs Bond is a contractual agreement between three parties - the Importer of Record, the surety bond company that issues the Customs Bond, and the US Customs & Border Protection (CBP).Ĭustoms Bonds are designed to ensure faster customs clearance as it guarantees the CBP the payment of any additional import duties, taxes, or fees that need to be assessed. A US Customs Bond is a mandatory document for importing goods into the US, as stated under the US Customs Regulations.

0 kommentar(er)

0 kommentar(er)